AI in Fintech: Personalized, Real-time Retirement Portfolio Management

18%

Improvement in Portfolio Outcomes2.3x

Increase in User Engagement30%

Reduction in Platform ChurnCustomer Overview

Our client, a US-based technology development company, builds products across domains like finance and logistics to solve real-world problems. They’ve developed top-performing SaaS platforms that help users automate tasks and enable businesses to secure continuous revenue streams. Backed by visionary leadership and driven by innovation, our client’s team is always in pursuit of building the next transformative solution.

Project Overview

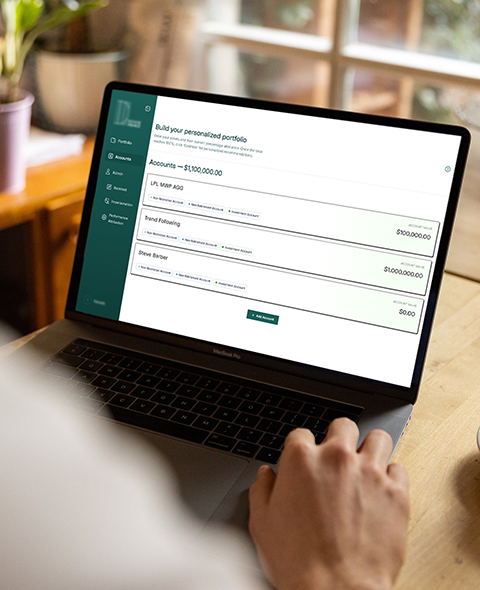

Fueled by a vision to help people achieve long-term economic security in their retirement years, our client set out to develop a fintech solution in the form of a SaaS-based wealth management software. Recognizing that retirement accounts like 401(k)s and IRAs often underperform due to poor investment strategies, the client aimed to offer accurate, data-backed, and personalized recommendations for asset allocation. They envisioned a platform that would hyper-personalize each user’s portfolio, actively monitor and manage it, and dynamically respond to changing market and economic conditions.

Challenges

Developing a seamless, hyper-personalized wealth management software for retirement portfolio optimization, including real-time data accuracy, intuitive visualizations, and tailored investment recommendations

- The platform users must be able to view accurate periodic (daily, weekly, monthly, yearly, or custom period) profits/losses on all their accounts (401K, IRA, etc.), both individually and combined.

- The system must provide personalized asset allocation recommendations after carefully considering the user’s financial goal, age, income, current portfolio, risk levels of investments, and changing market trends.

- All recommendations must be backed by up-to-date, accurate financial data coming from reliable sources.

- Complete financial information must be displayed in a simple, understandable visual format. Be it account-level profits/losses, transactions, etc., asset-level historic, current, and trend data, or asset allocation recommendations.

- The platform must provide a seamless experience to its users, from easy onboarding to effective portfolio optimization and smooth management, all while offering hyper-personalization.

Solution

Using AI for wealth management, we built a Retirement Portfolio Management Platform that unifies retirement accounts, visualizes performance, and personalizes investment recommendations to enable informed, goal-aligned portfolio decisions.

- Using Java 21, Spring Boot, Python, and Angular 17, we developed a responsive SaaS web application to help retirement account holders manage and optimize their investment portfolio across devices, including mobile.

- Developed integrations to onboard retirement accounts into the web app. Created data ingestion pipelines to aggregate transaction data of every account into a unified time-series format and built accurate profit/loss computation capabilities.

- Integrated multiple trusted data sources like Alpha Vantage and Twelve Data using AWS Glue to ensure accurate, real-time financial information. As data from different sources comes in varied formats, we cleaned, standardized, and stored the data in AWS S3 for reliable access.

- To present all financial data in a simple, understandable visual format, we used charts and tooltips, grouped data into periods (daily, weekly, etc.), and used color coding, like green for profits and red for losses. Provided legends and explanations in the UI and used frontend charting libraries, while ensuring well-structured, accurate dataset inputs in the backend.

- We build a portfolio optimization process, curating each step in detail from gathering users’ goals, analyzing the current portfolio, to providing portfolio improvement suggestions.

- Categorized users (aggressive, moderate, defensive investors), added weights to stocks (high-risk, balanced mix, safer stocks), and built a function to match the right stock buckets to the user’s goals.

- Built an ML predictive model using Scikit-learn to analyze risks and returns, consider every user’s unique goals, and provide reliable, personalized recommendations.

- To provide a seamless experience of this wealth management software, we enabled caching to allow the system to remember where the user left off in the journey and allow them to continue.

- Using AWS Cognito, we ensured secure sign-up, sign-in, and access control for all accounts on the platform.

Benefits

The AI-powered Retirement Portfolio Management Platform we developed offered the following advantages:

- End-users experienced up to 18% better portfolio outcomes through personalized asset allocation recommendations.

- User engagement increased 2.3x over 12 months, driven by clear, visualized account performance.

- The goal-aligned investment experience reduced the platform’s churn rate by 30% post-launch.

- The SaaS product built trust and credibility by integrating real-time data from verified financial sources.

Technology

- Java 21

- Spring Boot

- Python

- Angular 17

- AWS Glue

- AWS Cognito

- AWS Lambda

- AWS S3

- Scikit-learn

Industry

- Fintech

Conclusion

Bringing our client’s vision to life, we created a hyper-personalized portfolio management platform to help people achieve long-term retirement security. The responsive web app lets retirement account holders access real-time financial information through intuitive visuals and receive goal-aligned investment guidance. This resulted in 18% improved portfolio outcomes for users, a 2.3x increase in engagement over 12 months, and strengthened trust through reliable, verified financial data. Explore how our product engineering services can turn your ideas into secure, data-driven, high-impact solutions.

Frequently asked questions

How does Wealth Management Software personalize retirement portfolios using AI?

Wealth management software personalizes retirement portfolios by using AI to analyze a client’s age, income, risk profile, and market data in real time. Machine learning models recommend tailored asset allocations, continuously adjust strategies as conditions change, and ensure each portfolio stays aligned with long-term retirement goals.

Can AI wealth management platforms adapt recommendations based on market volatility?

Yes. AI wealth management platforms can adapt recommendations during market volatility by analyzing real-time financial data, predicting risk shifts, and automatically rebalancing portfolios. This ensures retirement strategies remain aligned with user goals, even when market conditions change rapidly.

How do AI-powered platforms differentiate between aggressive, moderate, and conservative investor profiles?

AI-powered wealth management platforms classify investors as aggressive, moderate, or conservative by analyzing financial data, past behavior, and risk tolerance. Machine learning models detect patterns, predict responses to market shifts, and create tailored portfolio strategies that align with each profile’s goals and comfort with risk.

How do AI-based robo-advisors compare to traditional human advisors in retirement planning?

AI-based robo-advisors offer low-cost, automated portfolio management with real-time rebalancing, while human advisors provide personalized guidance, emotional support, and complex financial planning. Many investors now use a hybrid approach, leveraging AI for efficiency and humans for nuanced decisions, thus balancing cost, convenience, and long-term retirement security.

What emerging AI trends are shaping retirement portfolio optimization for 2025–2030?

Between 2025 and 2030, retirement portfolio optimization will be shaped by AI trends like hyper-personalized asset allocation, predictive analytics for long-term risk, and hybrid human–AI advisory models. Enhanced regulation and explainable AI will also drive trust, making retirement planning smarter, more adaptive, and more transparent.

How are AI tools used for tax optimization within wealth management platforms?

AI tools optimize taxes in wealth management by analyzing income, portfolio performance, and regulations to forecast liabilities and suggest tax-efficient moves. They automate strategies like loss harvesting, retirement account allocation, and timing of withdrawals, helping investors reduce tax burdens while staying compliant.

What types of AI algorithms are best suited to forecast long-term portfolio outcomes?

AI models like LSTMs, Transformers, and reinforcement learning predict long-term portfolio trends by learning market patterns, while ensemble methods boost accuracy, and explainable AI adds transparency, making forecasts both precise and trustworthy.